LONDON, UK: Pearson Plc has agreed to sell Pearson Online Learning Services (POLS) to Regent LP, a global private equity firm focused on acquiring businesses and deploying its strategic and operational expertise to fuel growth and innovation.

A couple of years ago I posted about the NPE Report – Chartered For Profit: The Hidden World of Charter Schools Operated for Financial Gain. Well, here is a pandemic-focused follow-up that was released a couple of months ago, and while I mentioned in in one of the Network for Public Education’s newsletters, I didn’t post an entry specific to it.

Chartered for Profit II: Pandemic Profiteering

In this follow-up to our 2021 report, we again focus on the world of charter schools run for profit, a world both hidden and misunderstood. We focus on how for-profit operators expanded their reach and enrollment during the Pandemic years so that one in every five charter school students attends a school controlled by a for-profit corporation.

We pull back the veil on tactics and practices designed to reap as many public dollars as possible from charter schools while hiding behind laws designed to keep profit-making hidden from the public’s eyes. We also explain in detail how both large and small for-profit companies evade state laws by using related entities and a nonprofit facade to reap maximum financial advantage. From sweetheart deals to sweeps contracts to real estate bonanzas, our report explains the inner workings of the world of charters that put profits, not children, first.

You can view and read the report by clicking the image below.

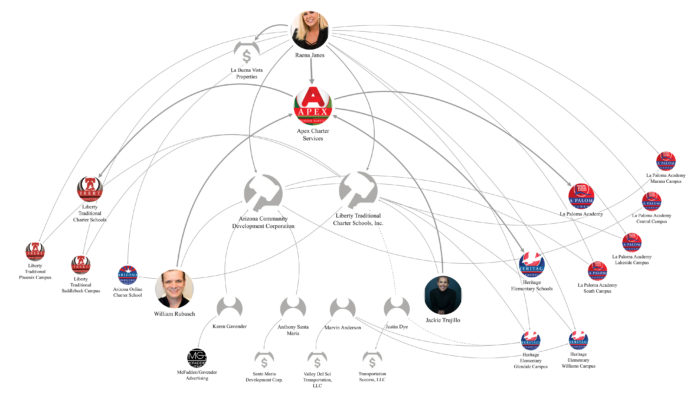

LittleSis map in the report

Arizona entrepreneur and charter school founder Raena Janes is the founder of Apex Schools, a for-profit EMO that manages nine schools that were also founded by Janes. The LittleSis map shows how not only Janes but also board members and employees of the schools have profited from contracts that include real estate, advertising, construction, transportation, and maintenance agreements. Since the 2010-11 school year, public documents show that Janes and her colleagues have extracted nearly $33 million taxpayer dollars from the charter schools.

Click on the image below to view the full, interactive LittleSis map.

Apex Schools: Designed to Enrich

In the Media

The Role Of Real Estate In The For-Profit Charter School Grift

It would be easy to assume that charter schools are in the education business, but in fact, many charter school companies appear to be in the real estate business instead.

In its new report, “Chartered for Profit II,” the Network for Public Education lays out the techniques for running a charter for profit, even if it is nominally non-profit, including the use of real estate deals.

To read the full story in the Bucks County Beacon, click here.

Report: Virtual Charter Schools Run For Profit Grew During Pandemic

The Network for Public Education has released a new report, Chartered For Profit II: Pandemic Profiteering, that looks at how charters run for profit fared during the previous pandemic years, including insights into how virtual charters, also known as cyber-schools, enjoyed a huge uptick in enrollment.

How can a charter be run for profit when virtually all states have outlawed for-profit charter schools? There are ways.

To read the full story in Forbes, click here.

Running a Charter School for Profit Should Be Illegal

From insider deals to real estate flips, the problems with charter schools run by for-profit corporations can’t be ignored. And growth in this sector is accelerating as operators use lax regulations and complicated corporate schemes to harvest public dollars from publicly-funded charter schools.

To read the Progressive, click here.

Some portions relevant to readers of this space.

During a 2016 visit to California, Network for Public Education (NPE) Executive Director Carol Burris met Michael Matsuda, the Superintendent of the Anaheim High School District. Matsuda showed her a flyer that advertised a new online Oklahoma-based charter school called Epic. The online school, which was actively recruiting students in his district, was giving enrollees $1,500 for a “personal learning fund,” along with free laptops, iPads, and Internet services.1 According to Woodward News, Epic, growing at a breakneck speed in Oklahoma, was also handing out free concert tickets, vacations, and other prizes for student referrals to its school, which had a four-year graduation rate of only 28 percent.2

Even as Epic was moving into California, it had been under investigation in Oklahoma for three years.3 While in theory, the school was run by a nonprofit called Community Strategies Inc., the real decision-maker was a for-profit company called Epic Youth Services (EYS). EYS received a 10 percent cut of taxpayer-funded revenue. Epic’s founders, David Chaney and Ben Harris were the co-owners of EYS, with Chaney serving as both the first superintendent of the school and the CEO of EYS.4

EYS attempted to block the Oklahoma investigation into its dealings, arguing that it was a private for-profit corporation and did not need to make its financial dealings public – even though it received public funds. After a ten-year investigation, Chaney, Harris, and Josh Brock, the long-time financial officer for both Epic Charter and EYS, were arrested in June of 2022 for cheating Oklahoma taxpayers out of tens of millions of dollars.5

The trio had regularly enrolled “ghost students,” including students in home and private schools, created fake invoices, used school credit cards for personal items, and dipped deep into the aforementioned “learning funds” account to make political contributions to stall and obstruct the audit. Chaney, Harris, and Brock regularly used the learning fund advertised in the Anaheim flyer not only as a way to entice new students to the school but as a personal piggy bank. Whether Chaney, Harris, and Brock will serve time for their crimes is yet to be determined. In a similar scam involving online charter schools in California known as the A3 scandal, the two criminal ringleaders behind the bilking of hundreds of millions from taxpayers were not required to spend even a single night in jail. 6

Perhaps most disturbing is that most of what Epic did is perfectly legal. Assigning no-bid contracts to friends and relations, giving parents bonuses for enrolling their own student or steering others to the school, and even paying teachers, as Epic did, for every student they enrolled were not the reason for the arrests. These practices are permissible in Oklahoma and would also be allowed in most other states. The Epic chain recently moved to selfmanagement and is on probation. Its future is unclear.

Since our March 2021 report the online for-profit charter sector has dramatically expanded its enrollment, accounting for most of the enrollment growth in charter schools during the pandemic. For example, enrollment in Epic, the corrupt online chain described above, more than doubled, increasing by over 31,000 students between the 2019-2020 and the 2020-2021 school years alone. (pp. 5-6)

The study revealed many serious reasons for concern, including for-profits having lower student achievement, lower graduation rates, and higher absentee rates. Students in for-profit virtual charters quickly fall behind those in brick-and-mortar schools. And the more services that the for-profit provides, the greater the adverse consequences to kids. (p. 9)

More disturbing is that 27 percent of the students attending for-profit-run schools were enrolled in low-quality virtual charter schools that teach students either exclusively or primarily online. (p. 10)

The pandemic certainly accelerated the growth of for-profit online schooling, a sector already the fastest-expanding charter school sector. Charters operated by the for-profit online giant Stride K12 increased from 72,474 students in 2019-2020 to 110,767 in 2020- 2021. Its strongest competitor, Pearson’s Connections Academy, experienced even greater proportional growth, from 53,673 to 85,749. Later in this report, we will discuss the growing numbers of students in virtual schools, the problems associated with that sector, and why for-profit operators are attracted to running them. (p. 10)

Thirteen EMOs run chains of 20 or more charter schools. Below are short profiles of the five largest for-profit operators with a multi-state presence. Four of the big five began with the charter movement in the 1990s. ACCEL, which is an outgrowth of the online for-profit charter Stride K12, is the most recent arrival and the fastest-growing for-profit chain. For more detailed information on each, see our 2021 report. (p. 24)

ACADEMICA

Managed schools: 205

Increase since 2020: 16 schools

National presence: Arizona, Colorado, Florida, Georgia, Idaho, Nevada, North Carolina, South Carolina, and Texas.

School type: Primarily brick and mortar, some virtual.

Corporate status: Privately owned by Fernando Zulueta, who serves as CEO. He also owns related organizations that do business with the school.

NATIONAL HERITAGE ACADEMIES (NHA)

Managed schools: 101

Increase since 2020: 1 school

National presence: Colorado, Georgia, Indiana, Louisiana, Michigan, New York, North Carolina, Ohio, and Wisconsin.

School type: Primarily brick and mortar. One virtual charter school.

Corporate status: Privately owned by its founder J.C. Huizenga, the CEO and president of NHA. He is the owner of related organizations. (p. 24)

ACCEL SCHOOL, a subsidiary of PANSOPHIC

Managed schools: 67

Increase since 2020: 17 schools

National presence: Arizona, California, Colorado, Michigan, Minnesota, Ohio, Washington and West Virginia.

School type: Brick and mortar and online.

Corporate status: A private company owned by CEO Ron Packard and Safanad Limited, an investment company located in Dubai.

THE LEONA GROUP, LLC

Number of Managed Schools: 50

Increase since 2020: 3 schools

National Presence: Arizona, Indiana, Michigan, and Ohio.

School type: Primarily brick and mortar. One virtual charter school.

Corporate status: Privately owned by its founder, Bill Coats, the CEO and president of Leona Group LLC. (p. 25)

This report began with the story of the Oklahoma virtual school giant, Epic charter schools. During the pandemic, the total enrollment in Epic charter schools rose to nearly 60,000 students. By the spring of 2021, it began to crumble — it fired its for-profit management company, and enrollment plummeted to 39,427 during the 2021-2022 school year.

Nationally, virtual charter schools run by for-profits, both large and small, dominate the virtual charter school landscape – a landscape that is growing. During the 2020-21 school year, an additional 175,260 students enrolled in virtual charters bringing the total enrollment in virtual charters to 483,871. Even more importantly, that shift accounted for over 70 percent of the increase in charter school enrollment between the 2019-2020 and 2020-2021 school years – the pandemic years. The increase was heralded as a victory for school choice. 56

In 2020-21, 141 virtual charter schools were run for profit and enrolled 61 percent of the nearly half-million students in virtual charter schools.

Eighty-three were run by two longstanding and prosperous charter chains – Stride K12 and Pearson’s Connection Academy. Together, these two corporations alone enrolled nearly 41 percent of all students in virtual charter schools that year.

During the first year of the COVID-19 epidemic, Stride K12 engaged in an aggressive marketing campaign that resulted in a sharp increase in enrollment. Charters operated by Stride K12 increased from 72,474 students in 2019-20 to 110,767 in 2020-21. One school alone, Ohio Virtual Academy, nearly doubled from 12,693 to 21,049 between 2019-20 and 2020-21. In 2021-2022, enrollment dropped to 16,161 — a substantial decrease but still higher than prior to the pandemic.

Like Stride K12, Connections ran television ads on cable networks throughout the COVID-19 pandemic.57 Pearson’s Connections Academy experienced an even more substantial proportional growth in enrollment than its primary competitor, from 53,673 to 85,749 during the pandemic’s first year.

Stride K12 “spent about $1.8 million on TV ads in just the first quarter of 2021, up from $1.2 million in the same period last year, according to an analysis for The Hechinger Report conducted by the consulting firm Kantar Media. Connections Education spent $1.2 million in that period, almost quadruple last year’s spending, the analysis showed.”

Why are Online Charter Schools so Attractive to Profiteers?

The answer is simple. There is a lot of money to be made. Although there are no real estate empires to be built, online charter schools provide enormous profit opportunities with their minimal overhead combined with the ease by which schools can “cook the books” on attendance.

In March 2022, The Government Accountability Office (GAO) issued a critical report on virtual charter schools.58 One of their concerns was the haphazard way that many virtual schools take attendance. The GAO investigators found that some schools relied on students only logging into a portal or a program, regardless of how long they stayed. While some virtual charters took daily attendance, others only took weekly or monthly attendance.

Because enrollment data determines how much money virtual charter operators will get from our state and federal tax dollars, manipulating those numbers can significantly enhance end-of-year profits. Fraud, costing taxpayers hundreds of millions of dollars, from enrollment schemes involving virtual schools has occurred with alarming frequency. Notable cases include the A3 charter school network, 59 Epic charter schools, 60 California Virtual Academy (CAVA),61 a Stride K12 school, and Ohio’s Electronic Classroom of Tomorrow (ECOT).62

Even for those not engaging in fraud, virtual charter schools are still a source of enormous profit, which is why for-profits operate over half of the sector. The GAO provides insight into why this is so. According to the report, “The student-teacher ratio across virtual charter schools was about 75 percent higher than for brick-and-mortar traditional public schools, according to 2017-2018 CRDC data.” The GAO found that while district public schools spent $13,646 per student on instructional staff in 2017-18 (50 percent of all of their income), virtual charters spent only $8,295 per student (25 percent of all of their income). (pp. 26-27)

STRIDE K12

Managed schools: 57

Increase since 2020: 6 schools

National presence: Arizona, Arkansas, California, District of Columbia, Florida, Idaho, Indiana, Kansas, Louisiana, Maine, Michigan, North Carolina, Nevada, South Carolina, Oklahoma, Ohio, Oregon, Pennsylvania, Utah, and Wisconsin.

School type: Virtual Schools

Corporate status: A publicly traded corporation (p. 27)

PEARSON’S CONNECTIONS ACADEMY

Managed schools: 39

Increase since 2020: 6 schools

National presence: Arizona, Arkansas, California, Colorado, Florida, Idaho, Indiana, Kansas, Louisiana, Maine, Michigan, New Mexico, Nevada, North Carolina, Nevada, South Carolina, Oklahoma, Ohio, Oregon, Pennsylvania, Texas, Utah, and Wisconsin.

School type: Virtual Schools

Corporate status: A publicly traded corporation (p. 28)

During the pandemic, the low-performing for-profit online charter schools expanded, and one chain, Charter Schools USA, jumped into the micro-school market. Whether or not such schools are in the best interest of children or taxpayers is irrelevant to the free market. The marketplace expands where there is an opportunity, using marketing to draw customers. The pandemic provided that opportunity. (p. 31)

Be sure to check out the full report.

12 Unique Blogs Are Written By Professors

12 Unique Blogs Are Written By Professors